The Kaizen System

Bringing Clarity to Every Business Challenge

Clarity

SYNERGY

PERFORMANCE

NURTURED TALENT

CONFIDENCE & DIFFERENTIATION

All the latest trends and insights

Riding the Wall: Unconventional Thinking in Business and Racing

"Sometimes you gotta do what you gotta do to make it work." — Ross Chastain

Have you ever felt like you were out of options, boxed in, and stuck on the path to failure? Hold that thought.

It's the final lap of a crucial NASCAR race at Martinsville Speedway. Ross Chastain, sitting outside the cutoff for the championship, needs to advance several positions in less than 20 seconds to keep his title hopes alive. Conventionally? Impossible. But Chastain isn't one to be confined by convention.

In a move that left the racing world both stunned and electrified, Chastain did the unthinkable. He put his car against the wall, floored the accelerator, and let physics catapult him past five competitors. Riding the wall at full throttle, he crossed the finish line with just enough points to advance to the Championship 4. It was a jaw-dropping spectacle that defied all norms of the sport.

This wasn't just a wild stunt; it was a calculated risk born out of necessity and creative thinking. Chastain's audacious move is a masterclass in unconventional thinking—a lesson that you, as an entrepreneur, can take to heart. When the usual strategies aren't enough, sometimes you have to ride the wall.

Breaking the Mold: When Conventional Strategies Aren't Enough

In both racing and business, sticking to the tried-and-true methods will only get you so far. The market is saturated with competitors all following the same playbook. If you want to leap ahead, you NEED to break the mold.

Think about it: Chastain could have accepted his fate, followed the usual racing lines, and ended the day with a respectable but insufficient finish. Instead, he recognized that traditional strategies wouldn't cut it. He needed something bold, something no one else had the idea or guts to try.

In your business, you might face similar crossroads. The market is shifting, and your standard tactics aren't delivering results. This is when unconventional thinking becomes not just beneficial but essential. It's about finding that unique angle, that innovative approach that sets you apart from the rest.

The Power of Thinking Outside the Box

Pressure can either crush you or catalyze innovation. Under the immense stress of the final lap, Chastain didn't buckle; he got creative. He recalled a move from a video game he played as a kid - yes, a video game - and brought it to life on the track. It was unorthodox, risky, and it worked.

We often impose limitations on ourselves, adhering to industry norms and "best practices" without questioning them. But true innovation happens when you dare to think differently. Remember, every groundbreaking idea was once considered crazy.

So how do you break free from these mental barriers?

Start by challenging your assumptions. Ask yourself, "Why do we do it this way?" and "What if we tried something entirely different?”

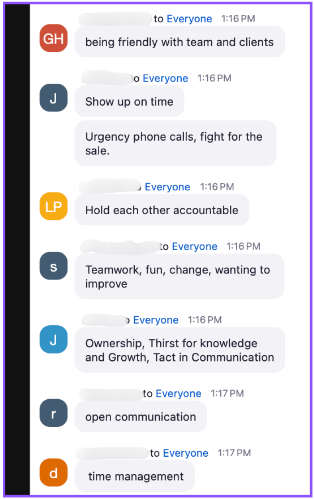

Encourage your team to share out-of-the-box ideas without fear of ridicule. Create a culture where unconventional thinking is not just accepted but celebrated (or get in touch if you need a hand in creating it).

Calculated Risk-Taking in High-Stakes Environments

Now, let's be clear: unconventional doesn't mean reckless. Chastain's move, while daring, was a calculated risk. He understood the potential consequences—damage to his car, the possibility of a crash—but he also saw the enormous upside.

In business, taking calculated risks is essential for significant gains. It's about weighing the potential rewards against the possible downsides and deciding if it's worth it. Data and experience inform these decisions, but sometimes you have to rely on your instincts too.

Maybe you've been contemplating entering a new market or launching an innovative product that doesn't fit neatly into your current portfolio. The safe route is to stick with what you know. But as Chastain showed us, sometimes the safe route won't get you where you need to be.

Fearlessness and the Willingness to Fail

One of the most compelling aspects of Chastain's maneuver was his willingness to embrace failure. He didn't know if his plan would work; in fact, no one had ever tried it before in a professional race. But he was willing to risk it all for a shot at success.

As an entrepreneur, fear of failure can be paralyzing. It keeps you tethered to the familiar and prevents you from seizing game-changing opportunities. But what if you reframed failure as a learning experience rather than a dead-end? Every misstep brings you one step closer to finding what does work.

Thomas Edison famously said, "I have not failed. I've just found 10,000 ways that won't work." Imagine if he had stopped at the first sign of failure. Embracing uncertainty and being willing to fail opens doors to possibilities that others won't even consider.

Applying Unconventional Thinking to Your Business

So how can you bring this mindset into your own entrepreneurial journey?

Encourage Creative Brainstorming: Set aside regular times for your team to share wild ideas, no matter how impractical they may seem.

Challenge the Status Quo: Regularly review your processes and strategies to identify areas where conventional thinking may be holding you back.

Embrace a Test-and-Learn Approach: Implement small-scale experiments to test unconventional ideas without massive upfront investment.

Build a Diverse Team: Different backgrounds bring different perspectives, fostering an environment where unconventional thinking thrives.

By fostering a culture that values innovation and isn't afraid of failure, you set the stage for breakthroughs that can propel your business forward.

Lessons from the Racetrack

Chastain's daring move teaches us several valuable lessons:

Innovation Requires Courage: Stepping outside the norm takes guts, but the rewards can be substantial.

Necessity Spurs Creativity: High-pressure situations can be the catalyst for innovative solutions.

Calculated Risks Can Pay Off: Assessing the risks and potential rewards carefully can lead to game-changing moves.

Don't Let Fear Hold You Back: Embracing the possibility of failure can free you to achieve greatness.

As Steve Jobs once said, "Innovation distinguishes between a leader and a follower.”

In a world where everyone is following the same racing line, sometimes you need to create your own path. Unconventional thinking isn't just about being different for the sake of it; it's about finding better solutions to complex problems. It's about daring to take risks when the potential rewards justify them.

So next time you find yourself boxed in with no clear path forward, remember Ross Chastain and ask yourself: What wall can I ride to overtake the competition?

Call to Action: Challenge yourself this week to think unconventionally. Identify one area in your business where traditional strategies aren't yielding results and brainstorm bold, new approaches. Share your experiences and ideas in the comments below—I’d love to hear how you're riding the wall in your entrepreneurial journey.

The First Lap: Importance of a strong start

"Getting off the line is half the battle." — An old racing adageWhen people talk about a high-stakes race, the spotlight often falls on the final lap—the dramatic showdown, the last-gasp overtakes, the champagne-spraying celebration. Yet seasoned drivers and racing teams know that a race can be won or lost in its earliest moments. The start of a race—those opening seconds and the first few laps—can set the tone for everything that follows.

In business, the same principle applies. While we love stories of epic finishes and come-from-behind victories, the reality is that laying a strong foundation from the very start can dramatically shape your ultimate success. As you kick-off 2025, think about these four insights from the track about why the early stages matter so much.

1. A High-Risk, High-Reward Moment:

Navigating the Crowded Field and Setting the Tone

The opening lap of any race is notoriously chaotic: cars are bunched together, all vying for the best position and racing line. Statistics consistently show that a large share of crashes and retirements occur in this early phase—somewhere around 30% of race incidents take place in the opening laps in many motorsport series. Why? Drivers are hungry to make immediate gains, the track is congested, and one small error can trigger a chain reaction of collisions.

Yet, this early chaos also creates big opportunities. A driver who nails the start, avoids collisions, and overtakes a few competitors can gain a decisive advantage. By staking out an early lead or at least establishing a strong position, they effectively set the strategic tone for the rest of the race. They can manage tire wear, control the pace, and force rivals to adapt to their decisions—rather than the other way around.

Business Parallel

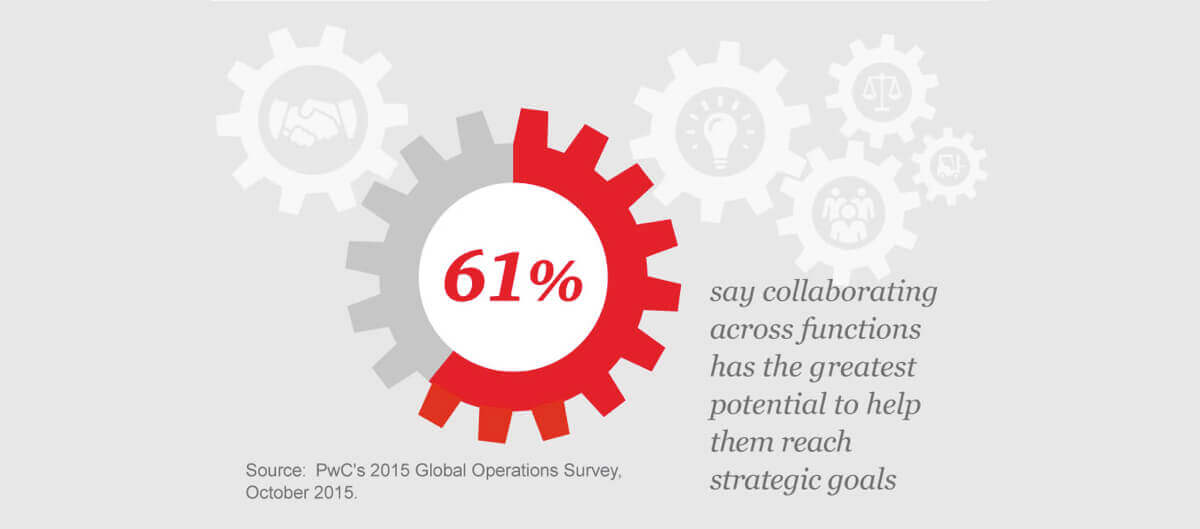

When a new year begins or a major product launch kicks off, the “field” is crowded with competitors introducing their own initiatives. Customers and investors are bombarded with fresh offerings and promises. If you can steer your organization through this initial scramble—by rolling out well-tested campaigns, anticipating market shifts, and clearly differentiating your brand—you claim the inside track.

Being proactive about setting the pace also helps you define best practices in your niche. Competitors will find themselves reacting to your moves instead of dictating their own, and this shift in dynamics can pay dividends throughout the year.

Lesson Learned

- Recognize that heightened risk at the start also means heightened opportunity.

- Maintain situational awareness so you’re neither blindsided nor trapped in the pack.

- Seize control of the pace early on, be it through strong marketing pushes, decisive product launches, or strategic partnerships.

2. Early Gains and Long-Term Consequences:

Compound Benefits and Lasting Damage

The first lap of a race can create compounding effects—both positive and negative. Drivers who succeed in gaining positions early often find themselves in control, while those who falter or crash are stuck repairing damage that can haunt them throughout the race.

Compounded Benefits from a Strong Foundation:

In many racing series, moving up the grid right after the lights go out can be a game-changer. Overtaking becomes harder as the field spreads out, tires wear down, and pit strategies lock in. Drivers who start near the front often have cleaner air, fewer obstacles, and the mental boost of running with the leaders. This momentum can compound, allowing them to plan pit stops at their preferred timing and forcing rivals to respond to their pace.

Business Parallel

Securing a strong foothold in the market early—whether by winning over customers, announcing key hires, or establishing a unique value proposition—creates a virtuous cycle of growth. Initial wins bring in revenue, which can be reinvested in product improvements or marketing. Positive press or social proof further amplifies your brand. Over time, these early moves can snowball into a competitive edge that’s tough to dislodge.

Lasting Damage from Early Mistakes

The flip side is equally powerful. An early crash or mechanical failure can mean pitting for repairs and watching the field race away. Even if the driver manages to rejoin, they’re often several laps down and dealing with a compromised car—both physically damaged and psychologically draining. Recovering from that kind of setback requires significant effort, and sometimes it’s simply not possible to climb back to contention.

Business Parallel

Early missteps—like a flawed product launch, an over-ambitious marketing campaign, or a crucial talent gap—can inflict “damage” on your enterprise. Budget overruns, reputation hits, or customer churn can hamper your resources and morale. Much of your focus shifts to damage control, rather than proactive strategy. It’s not always fatal, but it can mean you’re forced into a constant uphill climb for the rest of the year.

Lesson Learned

- Aim for a decisive start by establishing early wins; these can compound and sustain momentum.

- Recognize that early mistakes have outsized impacts—both financially and psychologically.

- If a mistake does occur, address it swiftly and transparently. The longer you wait, the more difficult recovery becomes.

3. Preparing for the Unexpected:

From Chaos to Opportunity

The start of the race can feel like controlled chaos. Drivers have tested and planned, but no amount of practice laps can perfectly replicate the unpredictable nature of those first few turns with 20 or more cars jostling for position. The secret to thriving in this environment lies in embracing unpredictability. Well-prepared drivers and teams view early mayhem not just as a risk, but also as an opening to leapfrog rivals who are slower to react.

Business Parallel

Entering a new year or launching a new product can be equally unpredictable. Markets can pivot unexpectedly, global events can disrupt supply chains, and consumer behaviors can shift overnight. If you’ve laid a robust strategic foundation and trained your team to be agile, you can pivot quickly when others are still scrambling.

Lesson Learned

- Prepare mentally and operationally for uncertainty. Role-play likely scenarios and “worst-case” planning.

- Build an agile culture that embraces real-time information and rapid decision-making.

- Spot—and seize—openings when rivals falter, whether that means capturing disgruntled customers or adapting your messaging to fit newly emerged trends.

4. Momentum and Confidence:

The Psychological Edge of a Strong Start

Racing is not just about machines and mechanics; it’s also a mental game. A driver who rockets off the line, gains positions, and survives the initial chaos enjoys a surge of confidence. This psychological edge often translates into better driving: sharper focus, smoother overtaking maneuvers, and the courage to push the limits when it matters most.

Business Parallel

A strong start to the fiscal year can similarly energize your team, attract investor interest, and force competitors to play catch-up. Early wins fuel everyone’s best efforts, and your organization can ride this wave of optimism toward bigger goals.

Lesson Learned

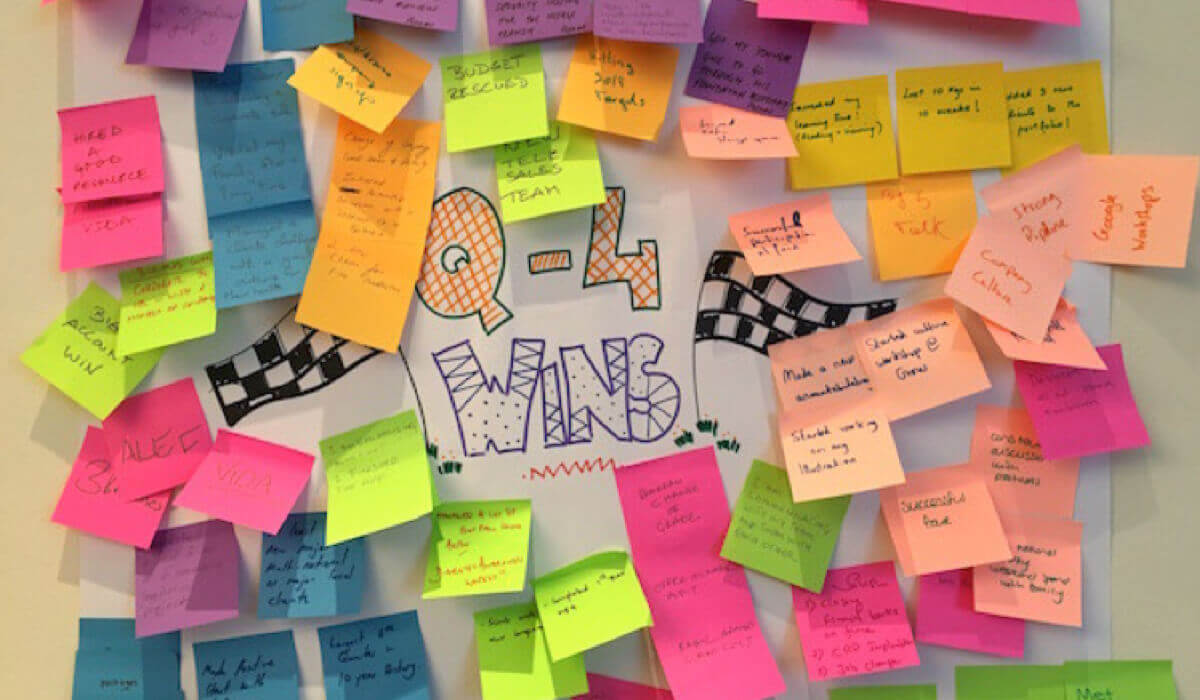

- Celebrate small successes in the early stages; they create a sense of momentum.

- Encourage a culture of confidence that is grounded in real achievements, not empty hype.

- Leverage this positive atmosphere to tackle tougher challenges down the line.

Looking Ahead: Seizing the Early Lead

In racing, the final laps are undoubtedly dramatic, but they’re often a direct consequence of what happened at the start. A strong opening stint can secure positions, build confidence, and set you up for a controlled and strategic approach throughout the race. In the same way, as you kick off a new year or a new initiative in your business, consider the profound impact those early moves can have.

Key Takeaways, and Action Items:

- Heightened Risk, Heightened Opportunity:Early on, everything is magnified. Proper planning and situational awareness can transform chaos into advantage.

Action: Be aggressive and decisive at the start, push your plan into play, and use the chaos and buzz to move ahead quicker. Want one of the Kaizen team to review your 2025 plan? PM/Comment 'Plan" and we'll set it up.

- Compounding Gains and Damages:Get ahead early, and you can build on that success. Make a significant mistake, and you could be paying for it all year.

Action: Early stage moves have disproportionate impact. Amplify EVERYTHING! And fix issues proactively and quickly, even if it costs a bit more. You can make it up the rest of the year.

- Preparedness for Unpredictability:Accept that you can’t script everything. Agility and rapid adaptation can turn the unexpected to your favor.

Action: Take the time to look around and notice your blindspots. Even if you can't preempt it, you will still benefit from knowing where the challenges will most likely come from. If anything were to knock you out of the race...what would it be?

- Momentum Breeds Confidence: Early wins elevate morale, sharpen focus, and position you as a market leader, keeping you a step ahead of the pack.

Action: celebrate wins, praise liberally, and keep the energy high. There's still among way to go in this, don't get too bogged down too soon.

Think of your early business moves as the first lap of a race. Done right, they can set you up for a confident and strategic approach that carries through the final lap—where, indeed, all the glory is won, but only if you laid the groundwork from the start.

Ready to win Stage 1?

If you’d like to discuss how to make the most of your early lead, PM me the word “Pole Position”, and let’s get your business roaring ahead, well before the final lap.

If you need to come back from a slow start, PM me the word "Rebound", and let's work on how to get you back quicker and stronger.

Ready to accelerate your business?

Have an executive team that can perform even better? Our Leadership Launchpad program delivers a 10x ROI on coaching investment, guaranteed! PM '10X' and we'll discuss it.

If your business is >$5m, learn about how our customized 1:1 business coaching programs can help you build a 9-figure exit.

If you're doing <$5m, get in touch to inquire about the V8 program - building a $10m business. Currently open by application only!

Also: Subscribe for more high-octane lessons from the racetrack.

How to Handle “I’m Going to Shop Around” During a Sales Call

When a prospect says, “I’m going to shop around,” during a sales call, it can be tempting to jump into defense mode or try to close the deal immediately. However, how you handle this moment can make all the difference in whether you eventually win the sale or lose the prospect entirely. Here's how to respond effectively—and what to avoid.What to Do

1. Acknowledge and Validate Their Concern

When a prospect mentions shopping around, it’s essential to validate their need to explore other options. You could say something like:

“I completely understand. It’s important to make sure you’re getting the best value.”

This not only shows respect for their decision-making process but also positions you as a trusted advisor.

2. Ask Questions to Understand Their Criteria

Once you've acknowledged their intent, dig deeper to understand what they’re looking for. Ask open-ended questions such as:

- “What factors are most important to you in choosing a solution?”

- “What specific outcomes are you hoping to achieve?”

3. Differentiate Your Offer

Use the information you gather to highlight what sets your product or service apart from the competition. Focus on unique value propositions, like superior customer service or proven success. This is a great time to introduce case studies:

“I’d like to share how we’ve helped similar clients achieve their goals, which might align with what you’re looking for.”

If you’re not already using case studies in your sales process, you can learn more about how to do so effectively in this blog post on using client case studies to sell.

What Not to Do

Handling objections effectively also means knowing what not to do. Here are three common pitfalls to avoid:

1. Don’t Speak About Competitors

While it might be tempting to compare your offering to the competition, avoid doing so. Speaking negatively about competitors can make you appear unprofessional and may raise doubts in the prospect's mind about your integrity. Instead, focus on what makes your product or service the best choice without mentioning others.

2. Don’t Drop Your Price Too Quickly

Lowering your price at the first sign of hesitation can devalue your offering and set a precedent that you’re willing to negotiate on price over quality. Instead, reinforce the value of your product or service and how it addresses the prospect’s specific needs. If price adjustments are necessary, approach it strategically later in the conversation.

3. Don’t Criticize the Prospect for Shopping Around

It’s crucial to maintain a positive and supportive tone throughout the conversation. Criticizing or questioning their decision to shop around can create defensiveness and harm the relationship. Remember, your goal is to build trust and show that you respect their process.

Conclusion

Hearing “I’m going to shop around” isn’t the end of the road—it’s an opportunity to demonstrate your value, build trust, and ultimately win the sale. By following the right steps—and avoiding common mistakes—you can turn this objection into a stepping stone toward success.

To further enhance your sales strategy, don’t forget the power of case studies. They’re a proven way to show prospects the real-world success of your product or service. For more on how to use case studies effectively, check out this blog post.

Rapid Rebound: A Crash Course On Quick Recovery in Racing and Business

"Success is not final, failure is not fatal: It is the courage to continue that counts." — Winston ChurchillBiggest race of the season. You’re at the wheel. Engine roaring, heart pounding. It’s been a relentless fight to get to the front of the pack. You’re approaching the final lap when suddenly - without warning - a rival intentionally clips your rear bumper. The car swerves, tires screech, and in a split second, you're off the track. The crowd gasps. But before the dust settles, you regain control, steer back onto the asphalt, and push forward with renewed determination.

In racing, as in business, setbacks are inevitable. But what sets champions apart isn't just their ability to bounce back - it's how quickly they do it. Agility and adaptability are the engines of rapid recovery, turning potential defeat into victory. In today's fast-paced business landscape, the speed of your rebound makes all the difference.

The Urgency of Quick Recovery and The High Stakes of Delay

In racing, a moment's hesitation can cost you the race. Every microsecond counts. Drivers make split-second decisions to navigate obstacles, adjust to track conditions, and outmaneuver competitors. A delayed reaction isn't just a minor hiccup; it's the difference between standing on the podium and watching from the sidelines.

Similarly, in business, slow responses may lead to lost opportunities, decreased market share, and diminished brand reputation. Markets shift, consumer behaviors evolve, and unexpected challenges arise without warning. If you're not ready to act swiftly, you risk being left behind.

When have you missed out because you didn't act fast enough?

Perhaps a competitor launched a similar product before you did, or maybe you hesitated to pivot your strategy when the market signaled a change. Perhaps you didn’t hire the prime candidate before your competition scooped her up, or you didn’t work fast enough to shut down a bad strategy.

These moments underscore the critical importance of quick recovery - specifically, Agility and Adaptability.

Agility: The Engine of Rapid Response

Agility isn't just about speed; it's about nimbleness—the ability to think and move quickly and easily. It's the capacity to assess a situation, make a decision, and act without unnecessary delay.

In racing

Split-Second Maneuvers:

Drivers constantly make rapid decisions to avoid collisions, overtake competitors, and navigate unexpected obstacles.

Instant Adjustments: They adjust their driving based on real-time feedback - grip levels, engine performance, race position, weather.

In business:

Swift Decision-Making: Leaders must make prompt choices in the face of sudden challenges - from a supply chain disruption to a PR crisis.

Streamlined Processes: Companies need efficient systems that allow for quick implementation of decisions.

During the 2020 Bahrain Grand Prix, driver Romain Grosjean's car crashed and burst into flames - a terrifying setback. Remarkably, he reacted with lightning speed, freeing himself from the wreckage in under 30 seconds. His agility saved his life.

While your business setbacks might not be life-threatening, the principle remains: agility can prevent a bad situation from becoming worse.

In your work:

Be Proactive, Not Reactive: Anticipate potential challenges and have contingency plans ready.

Empower Quick Decisions: Decentralize decision-making authority when appropriate so team members can act without bottlenecks.

Reduce Bureaucracy: Streamline approvals and processes to eliminate unnecessary delays.

Adaptability: Pivoting Under Pressure

Adaptability is your ability to quickly adjust to new conditions. In racing, weather changes can turn a dry track into a slippery hazard. The best teams adapt by switching to appropriate tires and adjusting their strategy on the fly.

In business, adaptability is crucial when:

Market Trends Shift: Consumer preferences can change rapidly due to technology, culture, or global events.

Unexpected Obstacles Arise: Pandemics, economic downturns, or regulatory changes can disrupt your operations.

Strategies for Adaptability

Cultivate a Flexible Mindset: Encourage your team to see change not as a threat but as an opportunity.

Build Versatile Teams: Hire and train employees who are skilled in multiple areas and comfortable with change.

Stay Informed: Keep a pulse on industry trends, emerging technologies, and global events.

Example: When restaurants faced lockdowns during the COVID-19 pandemic, those that quickly adapted by offering takeout, delivery, or meal kits were able to survive and even thrive despite the challenges.

Speedy Decision-Making - Overcoming "Analysis Paralysis"

In high-pressure situations, overthinking can be detrimental. Analysis paralysis occurs when over-analyzing leads to inaction.

In Racing: A driver who hesitates to overtake may lose the opportunity entirely.

In Business: Delaying a product launch to perfect every detail can result in missing the market window.

Techniques for Faster Decisions

1. Set Clear Objectives: Knowing your goals simplifies decision-making.

2. Trust Data and Instincts: Use available information but also trust your experience.

3. Establish Decision Frameworks: Create guidelines for common scenarios to expedite choices.

4. Limit Options: Too many choices can overwhelm; narrow them down to viable ones quickly.

Ask Yourself: What's the worst that can happen if I make this decision now versus delaying it?

Acknowledging the Role of Technology and Team Dynamics

While agility and adaptability are critical, they're often supported by technology and strong teams. Leveraging real-time data and having a responsive team amplifies your ability to rebound quickly. However, these topics are rich enough to deserve their own deep dive, which we'll explore in future discussions.

Mindset Shift: Cultivating Resilience

“Not every Setback is a Step Back" - Murtaza Manji

Resilience is the capacity to recover quickly from difficulties. It's not just about enduring challenges but transforming them into growth opportunities.

View Setbacks as Temporary: Recognize that setbacks are not permanent barriers but temporary obstacles.

Learn and Implement: Extract lessons from each setback and apply them immediately.

Positive Attitude Under Pressure

Staying calm and optimistic allows for clearer thinking and quicker action.

Maintain Composure: Stress can cloud judgment. Techniques like deep breathing or brief mindfulness exercises can help.

Focus on Solutions, Not Problems: Direct your energy toward actionable steps rather than dwelling on the setback.

Remember: Your mindset influences not just your actions but also those of your team.

Case Study: Rapid Rebound in Action - The Startup That Pivoted Overnight

Meet ‘Lisa', the founder of a boutique fitness studio. We started working together in Jan 2020. When the pandemic hit, in-person classes were no longer an option. Revenue plummeted, and the future looked bleak.

What did she do?

1. Immediate Assessment: Within 48 hours, Lisa convened her team to evaluate the situation.

2.Agile Decision-Making: They decided to shift to online classes, recognizing the growing demand for at-home fitness.

3.Quick Implementation: Utilizing simple technology (Zoom and social media), they launched virtual classes within a week.

4.Adaptability in Action: They adjusted class times and formats based on real-time feedback, offering both live and recorded sessions.

5.Mindset Shift: Instead of seeing the closure as a setback, Lisa viewed it as an opportunity to expand her reach beyond local clients.

The Result?

Sustained Revenue: They regained 80% of their revenue within two months.

Expanded Clientele: Clients from different cities and even countries joined the classes.

Future Growth: Post-pandemic, they maintained a hybrid model, doubling their customer base, revenue boost of 2.5x.

Actionable Strategies: Immediate Assessment Protocols

Establish a Crisis Response Team: Designate a group responsible for quick evaluations.

Gather Essential Data Quickly: Focus on key metrics that impact your immediate decision.

Communicate Promptly: Keep stakeholders informed to manage expectations.

Adaptive Planning

Develop Flexible Strategies: Create plans that allow for adjustments rather than rigid roadmaps.

Scenario Planning: Anticipate possible challenges and outline responses in advance.

Empower Your Team: Encourage team members to suggest adaptations based on their observations.

Continuous Improvement Processes

Regular Debriefs: After action is taken, review what worked and what didn't.

Implement Feedback Loops: Use customer and employee feedback to refine processes.

Invest in Training: Equip your team with skills to handle rapid changes.

In the high-speed arenas of racing and business, setbacks aren't just bumps in the road—they're tests of your agility, adaptability, and resolve. The faster you can assess, decide, and act, the better your chances of turning a potential loss into a win.

Recap:

Urgency Matters: Delays can be costly; speed is essential.

Be Agile: Cultivate quickness in thought and action.

Stay Adaptable: Embrace change and be willing to pivot.

Decide Swiftly: Overcome the paralysis of over-analysis.

Shift Your Mindset: View setbacks as opportunities for growth.

Final Thoughts

The ability to rebound quickly isn't just a nice-to-have; it's a competitive advantage. By prioritizing agility and adaptability, you're not just surviving challenges—you're leveraging them to propel your business forward.

Reflection

Assess Your Agility: How quickly does your business respond to setbacks?

Identify Areas for Improvement: Where can you streamline processes or empower faster decision-making?

Commit to Action: Choose one strategy from this article to implement this week.

Ready to accelerate your rebound rate?

If you need guidance on building agility into your business, PM me the word "Rebound", and let's work together to incorporate rapid responses in your business.

Ready to accelerate your business?

Have an executive team that can perform even better? Our Leadership Launchpad program delivers a 10x ROI on coaching investment, guaranteed! PM '10X' and we'll discuss it.

If your business is >$5m, learn about how our customized 1:1 business coaching programs can help you build a 9-figure exit.

If you're doing <$5m, get in touch to inquire about the V8 program - building a $10m business. Currently open by application only!

Also: Subscribe for more high-octane lessons from the racetrack.

When to Fire an Employee: A Business Coach’s Guide for Small Businesses

As a business coach, one of the things that stresses my clients out the most is making the decision to fire an employee. The impact extends beyond the individual to your entire team and can affect your business’s performance and culture. However, knowing when it’s time to let an employee go is crucial for maintaining a healthy and productive work environment.This guide will help you identify key situations where firing an employee might be necessary, drawing from our practical experiences of coaching 1,400 businesses globally, from Minnesota USA to Birmingham, UK and a few places in between1

1. Consistent Underperformance

In small businesses, every employee’s contribution is crucial. When an employee consistently underperforms, despite clear feedback, coaching, and support, it may be time to consider termination. For example, consider a Minneapolis based DEI consultancy firm where a consultant repeatedly fails to deliver on client expectations, resulting in negative feedback and lost contracts. Despite additional training and support, if there’s no improvement, retaining this employee could harm your firm’s reputation and client relationships.

Kaizen Tip: Always document your performance improvement efforts. This not only tracks progress but also ensures you have a clear record if termination becomes necessary.

2. Violation of Company Policies

Small businesses often operate on trust and a strong sense of integrity, making it critical to address any policy violations swiftly. Imagine a New York based financial advisory firm where an advisor breaches client confidentiality by sharing sensitive financial information. Such a violation could have severe legal and reputational consequences, necessitating immediate termination to protect the firm’s integrity and client trust.

Kaizen Tip: Ensure that your company policies are clearly communicated and understood by all employees. Regularly review these policies with your team to reinforce their importance.

3. Negative Impact on Team Morale

In small teams, one person’s negativity can quickly affect the entire group. Consider a Birmingham based law firm where a senior associate constantly undermines colleagues, creating a hostile work environment. This behavior can lead to decreased morale, increased stress, and even the loss of other valuable team members. If attempts to address these issues through mediation fail, it might be necessary to let the individual go to maintain a positive and productive work environment.

Kaizen Tip: Conduct regular one-on-one meetings and team check-ins to stay attuned to the team’s dynamics and address issues before they escalate.

4. Lack of Alignment with Company Values

For small businesses, aligning with company values is essential to maintaining a cohesive culture. Suppose you own a law firm that prides itself on inclusivity and respect, but you have an employee who regularly dismisses these values during client engagements. This misalignment can damage both your team’s cohesion and your company’s reputation. In such cases, termination may be necessary to uphold your core values and ensure your team remains aligned.

Kaizen Tip: During the hiring process, emphasize your company’s values and assess candidates on how well they align with those values. This proactive approach can help prevent misalignments later. For more hiring tips read our blog on how to create a winning team here.

5. Inability to Adapt to Change

In a small business, the ability to adapt to change is critical. Imagine you’re a tech startup in Edina, and you’ve recently implemented new software to improve efficiency. If an employee is unable or unwilling to learn the new system, despite training and support, their resistance can hinder the progress of your entire team. In such cases, it might be time to part ways.

Kaizen Tip: Foster a culture of continuous learning by offering regular training opportunities. Encouraging adaptability from the outset can help mitigate resistance to change.

Conclusion: Firing as a Last Resort

Firing an employee should always be the last resort after exhausting other options like coaching, training, and reassignment. When termination becomes necessary, it’s crucial to handle the process with professionalism and empathy, ensuring that the decision is well-documented and justified.

The goal is to build a team that is aligned, motivated, and capable of driving your business forward. See our guide on creating a high performing team here. By making thoughtful decisions, even when they’re tough, you can maintain a positive workplace culture and protect the future of your small business.

Elevate Your Business with Expert Coaching

Looking for tailored advice on managing your small business? Business coaching can equip you with the tools and strategies to make informed decisions, including when to let go of an employee. Whether you’re in Minnesota or elsewhere, I’m here to help you build a thriving, resilient business. Contact me today to learn how business coaching can take your business to the next level.

The Recent Microsoft Windows Outage: A Wake-Up Call

In today's digital age, small businesses rely heavily on their IT infrastructure to operate smoothly and efficiently. From managing customer relationships to processing transactions, the backbone of many business operations is a robust and reliable IT system. However, what happens when that system fails? Recent events have underscored the importance of having a solid contingency plan in place for IT disruptions.A global outage recently impacted Microsoft Windows PCs, causing significant disruptions across various industries. This incident, triggered by an update from a cybersecurity firm, led to widespread system crashes and operational downtime. While the details of this specific event are still unfolding, it serves as a stark reminder of the vulnerabilities inherent in our IT systems

IT contingency planning involves preparing for potential IT disruptions by developing strategies and solutions to minimize the impact on business operations. It's about being proactive, not reactive, ensuring that your business can continue to function even when faced with technical challenges.

Why Small Businesses Need IT Contingency Plans

1. Minimize Downtime: An effective contingency plan can significantly reduce the downtime your business experiences during an IT disruption. By having backup systems and procedures in place, you can maintain essential operations and continue to serve your customers.

2. Protect Data: Data is one of the most valuable assets for any business. Contingency planning ensures that your data is regularly backed up and can be quickly restored in the event of a system failure, preventing data loss and protecting your business from potential legal and financial repercussions.

3. Maintain Customer Trust: Customers expect reliability. An IT disruption that affects your ability to deliver services can damage your reputation and erode customer trust. A well-executed contingency plan demonstrates your commitment to reliability and customer satisfaction.

Key Components of an IT Contingency Plan

1. Risk Assessment: Identify the potential risks to your IT systems, including hardware failures, cyberattacks, software bugs, and natural disasters. Understanding these risks is the first step in developing effective mitigation strategies.

2. Backup and Recovery: Implement regular data backups and ensure that your recovery procedures are tested and effective. Cloud-based solutions can provide an additional layer of security and accessibility.

3. Redundant Systems: Invest in redundant systems and infrastructure to ensure that critical operations can continue even if one system fails. This might include secondary servers, alternative communication channels, and backup power supplies.

4. Incident Response Plan: Develop a clear incident response plan that outlines the steps to take during an IT disruption. This plan should include communication protocols, roles and responsibilities, and procedures for restoring normal operations.

5. Training and Awareness: Ensure that all employees are aware of the contingency plan and are trained on their roles within it. Regular drills and updates can help keep the plan current and effective.

Conclusion

The recent Microsoft Windows outage is a powerful reminder of the importance of IT contingency planning. For small businesses, the ability to quickly and effectively respond to IT disruptions can mean the difference between minimal impact and significant operational and financial loss. By proactively developing and maintaining a robust IT contingency plan, you can protect your business, your data, and your reputation, ensuring long-term resilience and success.

As a business coach, I encourage all small business owners to prioritize IT contingency planning as a critical component of their overall business strategy. Investing time and resources into this area can provide peace of mind and safeguard your business against the inevitable uncertainties of the digital world.

What to Do When a Prospect Ghosts You: Effective Strategies to Stay Connected

We've all been there. You have an amazing conversation with a prospect, they're interested in your services, and you know you can genuinely help them. The excitement is palpable. But then, silence. Days turn into weeks, and despite your follow-ups, you never hear from them again. It's frustrating, annoying, and can leave you questioning what went wrong.Here are some strategies you can implement to prevent prospects from ghosting you and keep the momentum going:

1. Put an Expiration Date on Proposals

Creating a sense of urgency is crucial. When you send a proposal, include an expiration date. This not only sets clear expectations but also encourages your prospect to make a decision within a specified timeframe. For example, you could state, "This proposal is valid for 14 days from the date of receipt." This approach leverages the principle of scarcity, subtly nudging your prospect to act before the opportunity slips away.2. Schedule a Follow-Up Meeting

Never end a promising conversation without scheduling the next step. Before you wrap up, set a specific date and time for a follow-up meeting. This could be a simple check-in to address any additional questions or concerns they might have. By having a follow-up meeting on the calendar, you keep the dialogue open and demonstrate your commitment to helping them. It also gives your prospect a structured timeline, reducing the chances of them fading away.3. Send a Video Message

Relying solely on emails and text messages for follow-ups can be ineffective. These methods are easy to overlook or ignore. Instead, try sending a personalized video message. A video allows you to convey your enthusiasm, recap key points from your conversation, and remind them of the value you bring. It's more engaging and personal, making it harder for your prospect to disregard. Plus, it sets you apart from competitors who stick to traditional communication methods.4. Send a Break-Up Message

If all else fails and you’ve tried multiple follow-ups without success, it might be time for a break-up message. This is a final attempt to elicit a response by letting them know you’re about to close their file. For instance, you could write, "I haven’t heard back from you and will assume you’ve decided to move in a different direction. Unless I hear otherwise, I’ll close your file in the next 24 hours." This approach often prompts a reaction because it creates a fear of loss. They may not want to miss out on your services and could respond to keep the conversation alive.Conclusion

Ghosting can be disheartening, but with these strategies, you can minimize its occurrence and keep the lines of communication open with your prospects. By creating urgency with expiration dates, scheduling follow-up meetings, using engaging follow-up methods like video messages, and, if necessary, sending a break-up message, you can increase your chances of turning interested prospects into satisfied clients. Remember, persistence and creativity in your follow-up approach can make all the difference.Mastering Communication Skills: A Guide for Entrepreneurs

Mastering Communication Skills: A Guide for Entrepreneurs

I recently had the pleasure of hosting a workshop at Breakthrough Fitness in North Minneapolis on one of the most crucial yet often overlooked aspects of entrepreneurship: non-verbal communication. The event was a fantastic opportunity to connect with fellow entrepreneurs and dive deep into strategies that can transform the way we present ourselves and our businesses.

The Importance of Communication Skills for Entrepreneurs

As entrepreneurs, developing strong communication skills is vital for success. Whether we're networking at events, pitching to investors, or creating social media content, the way we communicate and present ourselves has a significant impact on our business outcomes. I have included the main topics that we covered for those of you who were unable to join us.

Embrace Positive Internal Chatter

As a business coach, I often hear clients express that nerves and anxiety hinder their communication and presentations. To overcome this, start by changing your internal chatter. Instead of thinking, "I'm nervous and might mess up," or “I hate public speaking,” tell yourself, "This is my opportunity to shine and showcase my business." Our thoughts significantly impact our outcomes. Believing in your capabilities and focusing on what makes your business unique will make your communication more engaging and confident.

Understanding the Impact of Communication

Research indicates that only 7% of our communication impact comes from the words we use. The remaining 93% is split between vocal tone (38%) and body language (55%). This highlights the importance of not just focusing on what we say, but how we say it.

Vocal Tone

Your vocal tone can make a significant difference in how your message is received. Here are a few practical tips to vary your vocal tones effectively. (It was fun watching people practice this at our event!)

Vary Your Volume:Use louder tones for emphasis on important points and softer tones to draw in your audience’s attention.

Adjust Your Pace: Speed up your speech to convey excitement and urgency, and slow down to emphasize key points and allow your audience to absorb the information.

Change Your Pitch: Higher pitches can express enthusiasm or questions, while lower pitches can convey seriousness and authority.

Incorporate Pauses: Strategic pauses can give your audience time to think and reflect, and also help emphasize the importance of what you just said.

Body Language

Body language includes facial expressions, gestures, and overall body movements that complement your verbal message. Here are some tips to enhance your body language:Use Hand Gestures: Hand movements can help emphasize your points and keep your audience engaged. For example, counting on your fingers when listing points or using open palms to show honesty and openness.

Maintain Eye Contact: Making eye contact builds trust and rapport with your audience. Try to make eye contact with different individuals around the room to make everyone feel included.

Facial Expressions: Smile when appropriate to convey warmth and approachability. Use your eyebrows and other facial movements to express emotions and reactions.

Posture: Stand tall and avoid slouching to convey confidence and authority. Lean slightly forward to show interest and engagement with your audience.

Practical Exercises

During the workshop, we practiced changing our vocal tones and body language to enhance our communication. You can watch the replay of this Instagram Live session to see these techniques in action and learn how to apply them in your presentations:

Watch the Replay

Final Thoughts

Communication skills are one of the most important skills you can develop to succeed at business. Remember to spend more time focusing on how you are going to say it, not just what you are going to say. By emphasizing your vocal tone and body language, you'll be able to deliver your message more effectively and make a lasting impression on your audience.

Using client Case studies to sell

Case studies are real-life success stories from your clients that demonstrate the tangible benefits of your product or service. When prospects see the success others have had, it resonates with them on a deeper level, fostering trust and encouraging them to take the next step with your business. When done correctly, case studies are a great tool to drive up sales in your business.Here's how you can create compelling case studies to drive more sales:

1. Highlight the Client's Problem

Start by identifying the specific problem your client was facing before they discovered your solution. Talk to the frustrations and impact this was having on them. This sets the stage for the narrative and helps potential customers relate to the scenario.2. Showcase How Your Solution Helped

Detail how your product or service addressed and solved the client's problem. Be specific about the features or aspects of your solution that made a difference. This is where you highlight the unique value your business provides.3. Explain the Results Achieved

Speak to the specific outcome that was achieved. The more details the better! Quantify the results whenever possible. Did your client see a 50% increase in sales? A 20% increase in muscle mass? 30% reduction in operational costs? Concrete numbers and data make your case study more compelling and credible.Display Your Case Studies

Maximize the visibility of your case studies by featuring them on your website, social media platforms, and other marketing materials. The more places prospects encounter these success stories, the more likely they are to be convinced of your value. If possible, include the client's name along with the picture. This adds a personal connection and brings their story to life.

Remember, real stories sell. By showcasing the success of your existing customers, you not only build credibility but also inspire confidence in potential customers. Harness the power of your existing customers to attract new ones by highlighting the real impact of your solutions and see the difference it makes in your sales.

How to Make Virtual Meetings Engaging: 3 Effective Tips for Better Connection and Participation

Virtual meetings have gained a reputation for being boring, not as engaging as in person meetings and a waste of time! However, it's not usually the virtual or in-person setting that makes meetings less engaging; it's usually the way the meeting is run.Here are three tips to make your virtual meetings feel more connected and engaging, along with practical instructions and tools to implement these strategies.

1. Be at the front of the ‘room’

To make your virtual meetings more engaging, position yourself at the front of the room virtually by appearing directly in your slides. This approach helps your audience focus on you rather than just seeing you as a small box in the corner. By being front and center, you maintain their attention and enhance personal connection.

How to Appear in Your Slides Using Keynote:

1. Click on the slide where you want to appear.

2. In the top menu, select Insert > Choose to add an image or video of yourself.

3. Resize and position the image or video as desired.

How to Appear in Your Slides Using PowerPoint:

1.Click on the slide where you want to appear.

2.In the top menu, go to Insert > Pictures or Insert > Video to add an image or video of yourself.

3.Resize and position the image or video as needed.

2. Use Interactive Tools

Interactive tools are a great way to encourage participation during virtual meetings. They increase engagement and ensure everyone's voice is heard, making the meeting more dynamic and inclusive.

Examples of Interactive Tools:

Mentimeter: Mentimeter allows you to create live polls, word clouds, Q&As, and quizzes. Tips for incorporating Mentimeter into your meetings:

- Use live polls to gauge participant opinions or knowledge on a topic.

- Create word clouds to visualize participant responses to open-ended questions.

- Utilize Q&A sessions to address participant questions in real-time.

Slido: Slido is another excellent tool for live polling, Q&As, and brainstorming. Tips for incorporating Slido into your meetings:

- Conduct live polls to gather instant feedback on key discussion points.

- Facilitate Q&A sessions to ensure all participant questions are addressed.

- Use brainstorming sessions to generate and organize participant ideas collaboratively.

The chat box in virtual meeting platforms is an invaluable tool for getting quick responses from the group and gauging the energy in the room. Real-time feedback keeps your audience engaged, helps you adjust your approach on the fly and keeps the meeting lively and responsive to participants' needs.

Tips for Using the Chat Box Effectively:

- Ask Open-Ended Questions: Encourage participants to share their thoughts and ideas by asking open-ended questions.

- Quick Polls: Use the chat box to conduct quick, informal polls by asking participants to type "yes" or "no" in response to a question.

- Acknowledge Contributions: Regularly acknowledge and respond to contributions in the chat box to show participants that their input is valued.

By implementing these tips, you can transform your virtual meetings from mundane to engaging, fostering a more connected and interactive environment.

3 Proven Strategies to Make Your Business Stand Out and Wow Customers

Creating an X factor that sets your business apart is essential for attracting and retaining customers. By focusing on exceeding customer expectations, you can transform ordinary interactions into extraordinary experiences. Here are three proven strategies to make your business stand out and wow your customers.1. Special Touchpoints for WOW Moments

Incorporate Special Touchpoints: Strategically build special touchpoints into the customer journey to create ‘WOW’ moments that leave a lasting positive impression. For example, the Ritz-Carlton empowers its employees to create unique, memorable experiences for guests. When a child forgets their stuffed animal, a Ritz-Carlton employee might ship it back along with extra goodies and a photo album documenting the toy's 'extended vacation.' These magical touches make customers feel valued and special.

Kaizens Practical Steps for Success for your Business:

- Identify key points in the customer journey where you can add a special touch.

- Train your employees to recognize and act on opportunities to surprise and delight customers.

- Regularly brainstorm new ideas to keep your WOW moments fresh and impactful.

2. Go Above and Beyond to Rectify Mistakes

Exceed Expectations in Rectifying Mistakes: When mistakes happen, going above and beyond to rectify them can turn a negative experience into a positive one. Companies like Zappos are known for their exceptional customer service. If a customer receives the wrong shoes, Zappos not only sends the correct pair overnight but often lets the customer keep the original pair as a goodwill gesture. This proactive approach demonstrates a strong commitment to customer satisfaction.

Kaizens Practical Steps for Success:

- Develop a clear policy for handling customer complaints and mistakes.

- Empower your employees to take proactive steps to rectify issues and exceed customer expectations.

- Follow up with customers after resolving an issue to ensure they are satisfied with the outcome.

Establish a Strong Reputation: Building a reputation based on something other than your core offering can help differentiate your business and attract customers who value those additional elements. TOMS, for example, is known not just for their stylish shoes but also for their commitment to social good. With their One for One program, TOMS donates a pair of shoes to someone in need for every pair purchased. This mission attracts customers who want their purchases to make a difference, creating a loyal and passionate customer base.

Kaizens Practical Steps for Success:

- Identify a cause or value that aligns with your brand and resonates with your customers.

- Develop programs or initiatives that support this cause and integrate them into your business operations.

- Communicate your commitment to this cause through your marketing and customer interactions.

Creating an X factor for your business involves building special touchpoints to wow customers, going above and beyond to rectify mistakes, and building a reputation on something beyond your core offering. These strategies enhance customer satisfaction and loyalty while differentiating your brand in a competitive market.

By implementing these proven strategies, you can make your business stand out, attract new customers, and retain existing ones, ultimately driving your business success. Start today by identifying opportunities to delight your customers, handle mistakes with exceptional service, and build a reputation that resonates with your values and mission.

3 Ideas to Run an Effective Team Meeting

Team meetings are a waste of time, don’t achieve anything, and can be downright boring. But they shouldn’t be like that! If this sounds familiar then don't worry!. Here are three tips to transform your team meetings into productive and engaging sessions.1. Set Clear Objectives and Agendas

One of the most important steps to running an effective team meeting is setting clear objectives and creating a detailed agenda. This ensures that everyone knows the purpose of the meeting and what to expect.

Define Objectives: Before the meeting, identify the key objectives and desired outcomes. Communicate these to all participants beforehand. This keeps everyone aligned and focused on the same goals.

Create a Detailed Agenda: Outline the main topics, allocate specific time slots for each, and assign responsibility for leading each section. Distribute the agenda in advance so everyone can prepare accordingly and stick to the agenda!

Implementation Tips:

- Make sure all team members have the meeting blocked out in their schedule.

- Clearly communicate the focus of the meeting.

- Establish a culture of no waffling, no blaming, and backing up claims with data.

2. Encourage Active Participation

Fostering an environment where all team members feel comfortable contributing and sharing their ideas is essential for an effective meeting.

Rotate Meeting Roles: Assign different roles such as facilitator, timekeeper, and note-taker to various team members. This keeps everyone engaged and distributes responsibility. Rotating roles also gives team members a chance to develop new skills.

Use Interactive Tools: Incorporate interactive elements such as polls, brainstorming sessions, or breakout groups to encourage participation. Tools like whiteboards or digital collaboration platforms can help visualize ideas and keep everyone engaged.

Invite Input: Make it a practice to actively invite input from quieter team members. Direct questions to specific individuals to ensure diverse perspectives are heard and considered.

Implementation Tips:

- Rotate meeting roles to keep everyone engaged.

- Use interactive tools and methods to foster participation.

- Actively invite input from all team members, especially quieter ones.

3. Follow-Up and Accountability

Ensuring that meeting outcomes are implemented and progress is tracked is critical for maintaining momentum and achieving your goals.

Document Key Points: Record key decisions, action items, and deadlines during the meeting. Use a shared document or project management tool that everyone can access.

Assign Responsibilities: Clearly assign tasks and responsibilities to specific team members. Make sure everyone knows who is accountable for each action item.

Regular Check-Ins: Schedule follow-up meetings or check-ins to review progress on action items. This keeps the momentum going and ensures that commitments are met.

Implementation Tips:

- Document key decisions and action items.

- Assign clear responsibilities and deadlines.

- Schedule regular check-ins to track progress.

Conclusion

By setting clear objectives and agendas, encouraging active participation, and ensuring follow-up and accountability, you can transform your team meetings into productive, engaging, and impactful sessions that drive your business forward.

Implement these strategies in your next team meeting and watch how your team becomes more aligned, motivated, and effective. If you found these tips helpful, consider applying them to your business strategy. For more insights and personalized coaching, feel free to reach out!

How is the CoronaVirus Going to Affect Businesses in UAE?

Let's get the bad news out of the way first.Yes, there may be another recession coming.

But a recession, in and of itself, isn't a bad thing. Think of it like the economy going on a diet.

1 - Remove the Excess

Diets focus on cutting excess, not the necessities. There are two kinds of excess in the business world. The first are luxuries, such as fancy events, entertainment and excessive marketing. Even if you run an events or marketing firm, the question you will need to consider is: how do we make ourselves indispensable to our clients? The second excess are businesses that are unethical, fly-by-night, cowboy types. These are the first to shut down during a recession, and it's their exits that typically make the number of "failed" businesses so high. Don't let it scare you...these guys were never going to last anyway.

2 - Temporary

Diets are temporary. They often don't last forever, and neither do recessions. Even if it isn't the best or easiest time, focus on the value you're delivering. In every industry, some businesses will make it through. You need to focus on what will carry you over to the other side and yes, managing cash flow is crucial. Speak to your accountant about contingencies, and temporary measures you can implement to relieve some of the pressure on the business.

3 - Easier with Others

Diets are easier to stick to when you have a support network around you. In your business - who are the people that need you to succeed? Your team members, suppliers, strategic partners, investors, and your business coach. From negotiating better payment terms to communicating openly with your team, ensure you are leaning on your network for support - we are #inittogether.

4 - End Result is Always Better

The situation at the end of a diet is better than the situation at the start. Diets end when the body is healthier. Recessions end when the economy is healthier. Of course, it's better to maintain good health so we don't need diets, but it doesn't normally happen that way. There will always be pollutants to a healthy system, and diets and recessions will be necessary to flush them out.

Your primary focus should be on scaling your company in a way that it can weather the storms, for there will be storms. It starts with getting the basics in place, allowing you to run your business from a position of strength and control, rather than firefighting problems. Then you build the money, not just revenue but profitability and predictable cash flow. Then comes the sustainability of both...and that's all there is to it.

To support SMEs through this tough time, the Kaizen team are running free-to-attend online events throughout April 2020, in collaboration with our partners DMCC, In5 Dubai and AstroLabs, where we’ll discuss the changing business landscape, and what steps to take to stay ahead of the curve. Get in touch if you’d like to learn more.

Here’s to a phenomenal 2020

Four Reasons Why Employees Don't Take Ownership

If there was a poll on why businesses don’t excel, the “My employees don’t want to take ownership” option would definitely be in the top three reasons. In the hundreds of conversations I’ve had with business leaders over the last seven years, this issue has been raised almost every single time.So what is it about employment that brings about such disinterest? Or, is it even about employment at all - maybe the leadership, peers or company culture needs to be examined? Honestly, there’s usually more than one issue at play. Here are four possible reasons why this disenchantment may occur, and some suggested ‘antidotes’:

1- An employee doesn’t want to raise his/her own bar beyond his comfort level:

When you hire, you bring someone on to do a particular set of tasks. Over the months and years of doing the same (or similar) work with the same people, a level of comfort and complacency tends to set in.

You’d like the employee to proactively improve the role, continually increase output, and increase overall efficiency…but taking the ownership of improving the task would take away from that comfort - and few people look for discomfort. In addition, once a person has shown that he can deliver, you’d reasonably expect him to live up to that standard. If someone would rather just live on cruise control, they won’t make the mistake of showing you what they’re truly capable of.

If this disappoints you, let me offer a real-world reminder: someone who is driven, proactive, smart, generates ideas and follows through on them (does this sound like you?) is much more likely to be running their own business than working for someone else. This isn’t to say that no employees will be good; rather, understand that some will need you to help them become the best version of themselves, if they want it badly enough.

The Antidote: In business, as in life, prevention is better than cure. Don’t let complacency set in - keep people engaged and motivated to act, and encourage continuous learning and training. Let them see their own potential, excite them with their career prospects, and nurture their talents. Does that mean that some will get poached by your competitors? Yes. Is that a good reason to underachieve as an organization? Well…you decide.

2- An employee is afraid of blame if her initiative fails:

A common obstacle for many initiatives is the fear of failure. This fear is normal - it’s ok to be uncomfortable with the idea that an idea may not work. This can be overcome, through support, learning and continuous effort. In some organizations, however, there is another fear associated with taking the initiative: the fear of blame. This fear is paralyzing, and stronger perhaps than any other fear. But can you imagine a world without failure? What a bleak, boring world it would be. It was failure after failure that gave us the light bulb, the telephone, and every other breakthrough invention we can’t live without today. How likely would it be for us to have these tools, if every failure was met with blame and accusation?

The Antidote: “Show me a man who has never failed, and I’ll see a man who has never attempted anything.” If you want the firm to reach new heights, it will happen at the cost of some slip-ups. The greater the fear of the blame for slip-ups, the less likely that any new steps will be taken. This doesn’t mean everyone gets free rein to waste resources, though. Identify your future stars, sit with them, listen to their ideas and discuss the requirements. The greatest weapon in their arsenal will be your belief in their abilities - help them to help you.

3- There’s no glory in the grind:

As Maslow identified in his Hierarchy of Needs, once the “basic needs” are met, a person has two psychological requirements: ‘Belonging’ and ‘Esteem’. ‘Belonging’ is to do with an individuals’ personal and social circle, and ‘Esteem’ has two parts: Prestige and Feeling of Accomplishment. In a work setting, these are achieved through awards, recognition and titles. The “What’s In It For Me?” should be addressed, not just in marketing products to prospects, but also when encouraging participation internally. There is - perhaps rightfully, in some cases - the perception that employees are not valued by organizations, and this attitude is a major issue that needs to be addressed.

The Antidote: If a team member is going out on a limb, and is willing to take the risk that it may not work, it would only be fair to give them the appropriate glory for the effort, too. There are two direct benefits to this. Firstly, if the idea works out, the appreciation should cause a huge boost in their self-esteem, their pride in their work, and their reputation in the firm. If it doesn’t work, the acknowledgement will still show that the effort is appreciated, and that the firm believes in the person - this can work wonders for long-term loyalty. Secondly, it gives a message to every other person: your performance is not going unnoticed. A ‘not-A-but-not-C-level’ team member will see that those who try being praised, and it may be all the encouragement they need to up their game. Conversely, if someone is not willing to push themselves, their lack of effort will be highlighted over time. Either way, it benefits the company in the long-run.

4- There is a culture of apathy:

On her first day on the job, the bright-eyed, energetic young lady was brimming with ideas on how to improve performance. Everywhere she looked, she saw potential gains, growth and results. She started writing a list of all her thoughts, afraid to lose them if they weren’t committed to paper. Twenty minutes and seventeen ideas later, her assigned mentor - a middle-aged, pleasant man who had been in the company forever - looked over at the excited recruit muttering to herself, and saw her list. Interrupting her train of thought, he asks: “Do you truly think nobody here has ever thought of these ideas before?” She pauses, unsure how to reply. He continues: “See Alex over there? He still has his ideas list from three years ago in his drawer somewhere. Martin, over in the corner - his ten-point plan that he made a year ago was just taken off his wall last month. And the initiatives I proposed when I first joined - let’s just say, we’re still waiting for them to be reviewed. Don’t waste your time on this. Frankly, my dear, they don’t give a damn.”

And, just like that, another one bites the dust. She glances down at the paper, tears the sheet off, and drops it - along with her enthusiasm and dreams, into the trash basket.

The Antidote: you’ll need to take a long, hard, honest look at the culture that exists in your office. Remove the rose-colored glasses, and critically examine how people behave and interact. To have a beautiful garden, you must be willing to kill the weeds - but identifying them is a whole different challenge. Have in-depth conversations with both senior and junior people, understand if a culture of apathy exists, get real answers on the why and how. Then the process of culture change - and instilling a culture of ownership - can begin. It is a long and challenging journey, but the results are multifold.

The Real Cost of Inefficiency

Businesses typically sell a product or service that the end customer needs or wants. The profitability comes when the business is able to sell for more than what it costs to produce. This is of course an overly simplified view, but the basic premise remains the same regardless of company size, offering, industry or sector.On paper (targets, plans and forecasts) it can all look pretty straightforward. In reality, there are endless variables, a dozen processes, several departments and anywhere from tens to hundreds of people involved to reach the end result.

So, what happens when:

The predictions aren’t right

The expected timelines are exceeded

The results are inadequate

The firefighting of any mistakes made eats up valuable time and resources

And when inefficiencies creep in?

The initial profit often quickly turns into operating cost to finish the project, and I’ve lost count of how many times I’ve heard of businesses finishing a project at a loss because they were contractually bound to the client.

The commitment to finishing is applaudable…finishing at a loss is anything but. Driving up efficiency in an organisation is essential to keeping it profitable. And, let’s face it: your involvement as a manager isn’t scalable or replicable. Your watchful eye may help run a smooth operation now, but what happens when the company grows to the point where you can’t keep an eye on everything? More importantly, what happens to the business when you want to set up a second business that demands your time, want to reduce your hours, or go on holiday (and answering emails and calls while on the beach is not a holiday!)?

The Kaizen system and strategies that we use with over 700 businesses in the UAE help business owners, c-level executives and senior management teams leverage their time and do “ever more with ever less”. Reducing the time and resource wasted in firefighting, overcoming obstacles to efficiency and creating systems and structure that are scalable are some of the goals we work towards.

If you’d like to see how this can work for you, get in touch and reserve an initial free business coaching session. Most business owners and team leaders haven’t been coached before, which is why the first session is always free: to give you value first, and then see if this is something you’d like to continue.

The 5 Critical Keys to Setting Powerful KPIs

With the growing pressure on businesses, people are working 9, 10, 11-hour days – powering through lunch, typing out reports with one hand while rummaging through a Fattoush salad with the other. Team members have missed birthdays, meals and exercise to try and reach their yearly goals, and yet, is your business truly better served?What metrics (besides revenue and profits) are you utilising to predict how well your company will do at the end of the month, quarter or year?

The Role of KPIs (Key Performance Indicators)

Key Performance Indicators (or, KPIs) are trackable metrics which show how well a business is moving toward its goals. These numbers should tell you, in one look, the state of the company, the challenges that are ongoing, and the results you can expect in a week, month or even a quarter.Stephen Hawking, world-renowned scientist & astrophysicist said “The universe is in a state of constant motion. It either expands or it contracts.” The same dynamic nature exists in business. The trick is identifying the change early enough to capitalise or make corrections.

As SME owners seeking explosive, lucrative growth, we need to look in the mirror and ask: is this the fastest, most sustainable way to:

• Scale revenue

• Decrease unnecessary expenses

• Increase the results of each member of the team

Tracking these is the common aim when setting KPIs, yet most won’t hit the mark because setting and keeping great KPIs requires immersive, consistent and thoughtful work.

And we all know ‘busyness’ is a lot easier than business.

But, here’s the benefit: Truly effective KPIs should allow you to look into your business and, at a glance, say “If I stay at this speed on the current course… here’s where my business is heading, and here’s how long it should take me to get there.”

Since every business is unique in its strategic goals and how they wish to pursue them — we’ve put down the 5 key characteristics any powerful KPI should have.

5 Characteristics of Powerful KPIs

Simplicity

KPI’s must be easy to understand.The best way to create crystal clear objectives for your team is to try and limit yourself to a 5-7 word description of a metric.

Remember KISSS: Keep It Short, Sweet and Simple — this will make it easier for your team to digest, and encourage you to focus in on what your business really needs.

Based on Valid Data

You can’t fix what you don’t track.Set your KPIs only on the basis of what you can accurately measure. The system of collecting valid data doesn’t need to be complicated or overly-sophisticated, it just needs to be able, reliable and especially, accurate.

Bad data can be worse than none at all — which is why it’s critical to ensure you have proper systems in place to collect valid and usable information moving forward.

Context

What do these numbers mean?We touched on the importance of setting clear, simple objectives (that is, clarifying the ‘what’). Context clarifies the ‘why’, helping us understand what hitting these targets would actually mean for our business.

Without context for you and your team, your KPIs have no specific meaning. Especially as it relates to how these metrics play into your short + long term goals, and whether the figures in the spreadsheet tell a story of expansion or contraction for your business.

Empower Users

Achieving KPI’s will likely make the business better and richer.But what exactly is the personal/professional benefit for the people who helped the company reach this new level of success? Beyond their basic compensation, what incentive do they have to go the extra mile?

Psychologists studies have proven that people act most powerfully in their own self-interest. Tap into this part of human psychology and use it to fuel your business’ success.

Answer the innate silent question of WIIFM ‘what’s in it for me?’ — and supercharge your team by linking their benefit and progression with that of the company.

Audit

Business is dynamic.Every so often, it’s a good idea to look around and ensure the indicators are still pointing us in the right direction. KPI Audits with necessary tweaks can keep your KPIs relevant — guiding your company’s workflow and business decisions along a successful path.